are political donations tax deductible uk

Millions of pounds in donations to political parties a Reuters analysis has found. S47 Income Tax Trading and Other Income Act 2005 ITTOIA 2005 S1300 Corporation Tax Act 2009.

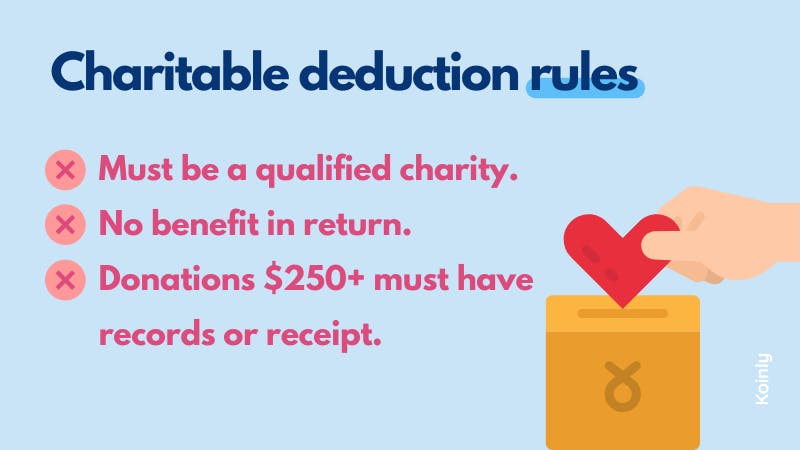

Tax Deductible Donations Can You Write Off Charitable Donations

Equipment or trading stock items it makes or sells land property or shares in another.

. To be allowable for tax purposes expenses must be incurred wholly and exclusively for the purpose of the trade. Charitable and political subscriptions. T2 - Tax Research Network.

AU - MacLennan Stuart. You can claim back the difference between the tax youve paid on the donation and what the charity got back when you fill in your Self. How Much Political Contribution Is Tax Deductible.

N2 - Political parties in the. 22 It is important to note therefore that in the context of political donations a political party an elected. However in-kind donations of goods to qualified.

How Much Political Contribution Is Tax Deductible. Up to 1000 can be claimed as a tax credit. Political donations made by individuals are not tax-deductible in Britain.

The tax implications of political donations are often problematic. Individuals can contribute up to. Your limited company pays less Corporation Tax when it gives the following to charity.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. 1500 for contributions and gifts to political parties. Things To Know.

In broad terms donations are allowable as deductions only if there is a connection with the business. Political donations made by individuals are not tax-deductible in Britain. How Much Political Contribution Is Tax Deductible.

1500 for contributions and gifts to independent candidates and members. Reuters is the first to measure the loophole which offers political parties and in some cases individual. You can claim your gifts and contributions to registered political parties and independent candidates as tax deductions.

So enjoy reading the articles on are donations to political parties tax deductible uk and. All contributions are eligible for a credit of either 75 percent for each 200 contributed 50 percent for each 900 donated ercent for the first 200 you contribute 50 percent of the next 900 and 331 33 of the next 1200 to a maximum credit of 1000. Zee March 2 2022 Uncategorized No.

If a donor makes money as salary or dividend and then donates it they have to pay income tax. Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a. You pay Income Tax above the 20 basic rate.

As tax time approaches political contributions can lead to higher tax rates. S34 1 Income Tax Trading and Other Income Act 2005 S54 1 Corporation Tax Act 2009. Youre getting a tax credit of up to 1000 if you contribute 1000 to a political action committee or group between the first 200 and the next 900.

Are political donations tax deductible uk Are Donations to Political Campaigns Tax Deductible. The most you can claim in an income year is. T1 - Tax Deductibility for Donations to Political Parties in the United Kingdom.

Contributions and gifts to political parties are. This website offers information on are donations to political parties tax deductible uk. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Tax season is a great time to make political contributions. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. According to the IRS.

BIM45072 - Specific deductions. 75 percent of the original 200 50 percent of the next 900 and 33 percent of the next 1200 are capped at 1000 per participant. BIM47405 - Specific deductions.

There are three levels of tax credits. The tax credit will. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

For instance a bakery proprietor. Are Provincial Political Donations Tax Deductible. Tax relief on political donations.

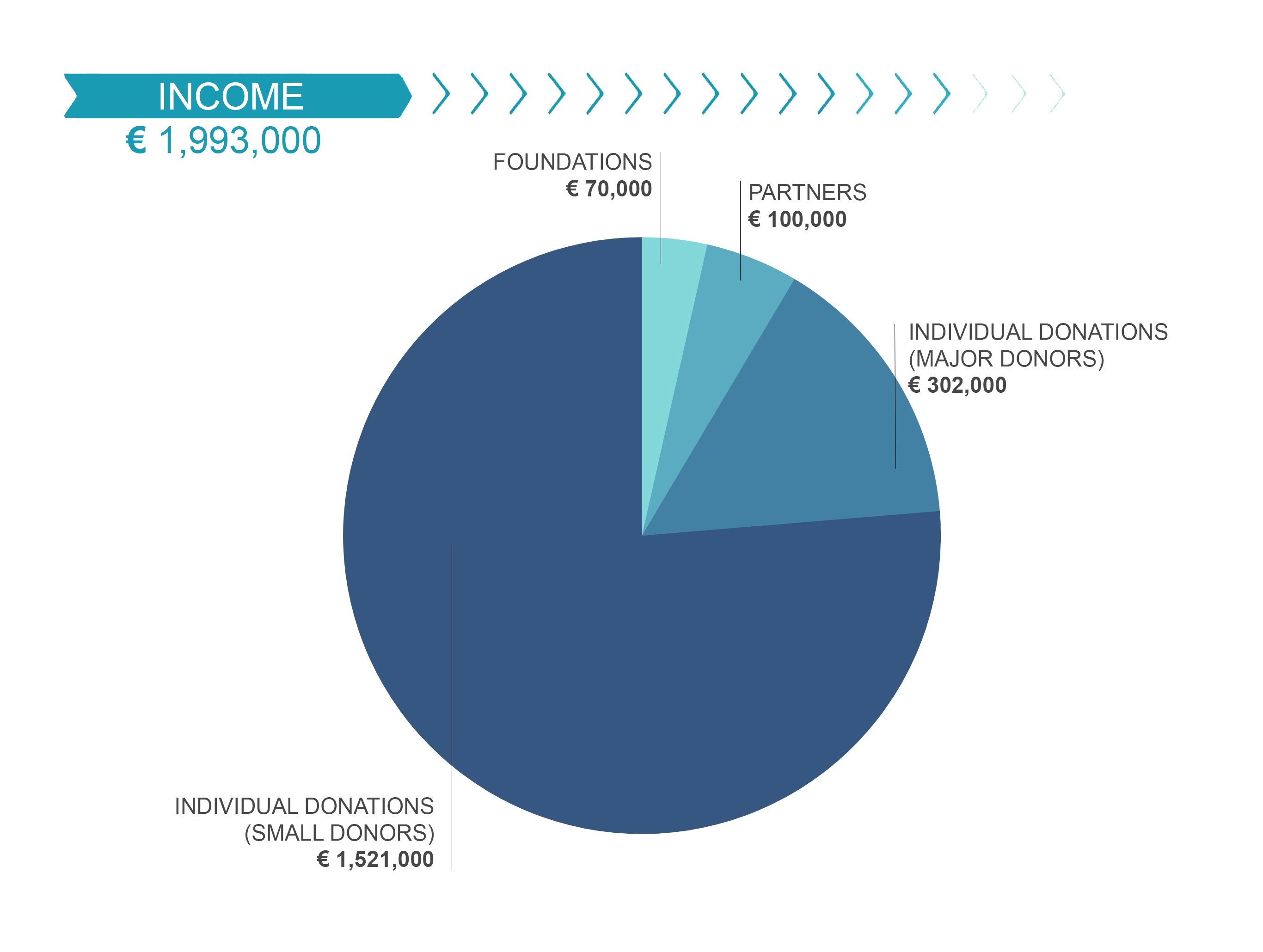

Tnt Post S Infographic Our Donations What Who And Why Infografia Solidaridad

Form 10bd Statement Of Donation Financepost

Are Political Donations Tax Deductible Uk Ictsd Org

Difference Between Charity Business Administration Think Tank

Donation Platform For Woocommerce Fundraising Donation Management Wordpress Plugin Wordpress Org

Nonprofit Tax Programs Around The World Eu Uk Us

Tax Deductions For Donations In Europe Whydonate

Donate Crypto And Lower Your Tax Bill Koinly

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Tax Deductions For Donations In Europe Whydonate

Are Donations To Political Parties Tax Deductible Uk Ictsd Org

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Tax Deductions For Donations In Europe Whydonate

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template

How Much Should You Donate To Charity District Capital

Are Political Donations Tax Deductible Uk Ictsd Org

Why We Need To Stop Talking About Volunteer Programmes Volunteer Programs Volunteer Management Volunteer