defer capital gains taxes indefinitely

Furthermore if you keep your monies in that fund for at least 10 years you dont. The IRS and US.

Ways To Potentially Defer Capital Gains Tax On Stocks

Instead of their equity going toward the payment of income taxes an Investor will be able to exchange into larger properties with greater income potential.

. If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given. Capital gains taxes can be delayed indefinitely. There is also 30 Income Tax relief on the investment.

Download 99 Retirement Tips from Fisher Investments. Ad The Leading Online Publisher of National and State-specific Legal Documents. Investors decide when and in some cases whether to pay taxes on investment gainsThe discretionary nature of capital gains taxation thus creates a lock-in effect because the longer an investor holds appreciating property before.

Reef Point LLC August 12 2020. Get more tips here. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

The Deferred Sales Trust. Additionally the trustee invests the sales proceeds approved in advance by the SellerTaxpayer into cash or whatever types of investments suit their needs income. This basis lasts for five years so any funds withdrawn from the QOF in that time are fully taxable.

In simplest terms a 1031 exchange allows you to swap rather than sell thereby deferring capital gains taxes indefinitely. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a lower rate.

A long period of low interest rates has shifted attitudes in that regard. The DST defers capital gains and other taxation on the sale. Ad Tip 40 could help you better understand your retirement income taxes.

If the heirs sell in the future theyll have to pay tax only on the gain since they inherited it. Another way to avoid capital gains tax is to own the property for a lifetime then pass it to heirs. Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities.

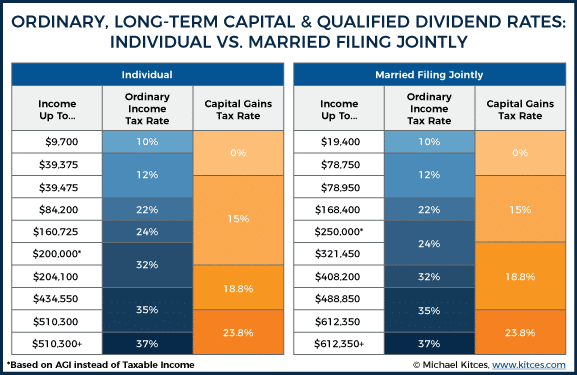

How Much Is Capital Gains Tax. This deferral can be for as long as the seller chooses. How Long Can I Defer Capital Gains Tax.

Because of the COVID-19 pandemic the IRS has provided relief for the. Normally to defer the taxable capital gains into a QOF the profit must be reinvested into a QOF within 180 days of the sale date. Know More You should consider a 1031 exchange if.

You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to cash out of the fund 100 tax free. Back in the day there was a strong sense that a tax deferred was almost as good as a tax avoided. The DST bridges the gap between selling the property and sheltering the capital gains from it.

Investment Period Extended To Defer Capital Gains. The tax treatment of capital gains differs from that of other income types because taxation occurs upon realization rather than accrual. A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you defer capital gains tax 30 years.

Actually there is only one reason why anyone should defer capital gains taxes. You should lower the amount of capital gains tax on investments lasting 5 or 7 years when held for 10 and 15 years respectively. Under securities law the investors ownership of the stock ends at the time of the short sale not when the stock is delivered.

The property is inherited at its stepped-up value. The tax on those capital gains is deferred until the end of 2026 or earlier should you sell the investment. By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property.

If you invest that 250000 gain in a QOF within the required 180-day period you can defer the gain and the tax on the sale. Assets can be swapped until death and beneficiaries can receive a one-time base increase potentially eliminating capital gains tax. In a nutshell you defer taxes then reduce then you eliminate them.

Capital gains taxes often reduce profits by 40 or more. However no matter your income status. Finding ways to defer taxes and invest the excess is one of the ways that the 1 continues to build astronomical wealth.

Ad Find Recommended California Tax Accountants Fast Free on Bark. Now recognition of capital gains can be spread out in installments in a manner that is selected by the SellerTaxpayer in advance or at the Sellers direction can be deferred indefinitely. Literally the tax consequences of the sale can be deferred indefinitely.

For realized but untaxed capital gains short- or long-term from the stock sale. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Department of the Treasury encourages investors to do this through tax-deferral advantages.

This strategy can be applied to a wide variety of asset types and is a compelling alternative to more widely-known. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. Not only can you delay paying taxes on capital gains depending on how long your gain has been held in the fund your basis can increase by up to 15.

If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. Your properties have high tenant turnover because of the neighborhood or the property. Get Access to the Largest Online Library of Legal Forms for Any State.

You own older properties that have high maintenance expenses.

Ways To Potentially Defer Capital Gains Tax On Stocks

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax Deferral Capital Gains Tax Exemptions

High Class Problem Large Realized Capital Gains Montag Wealth

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Capital Gains Tax In The United States Wikiwand

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Taxes White Coat Investor

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Tax In The United States Wikiwand

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Deferred Sales Trust Max Cap Financial

How Capital Gains Affect Your Taxes H R Block

High Class Problem Large Realized Capital Gains Montag Wealth

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

Capital Gains Tax Deferral Capital Gains Tax Exemptions

High Class Problem Large Realized Capital Gains Montag Wealth